Angel Investors VS Venture Capitalists: Who Provides Seed Funding?

But of course, just like with every hero origin story, you have to have your guru character, your mentor, and lots of serious cash so that you can tap into that spark and nurture it until it's scalable enough to change the world. That's where seed funding comes in – the spark that ignites your business and propels it to greatness.

And so, where is that saving grace then? Step out of the darkness the two most famous Startup World superheroes, Angel Investors and Venture Capitalists. They swoop down, cape flapping and checkbook open, to fuel the blaze of your dreams and fly over the hurdles ahead of you.

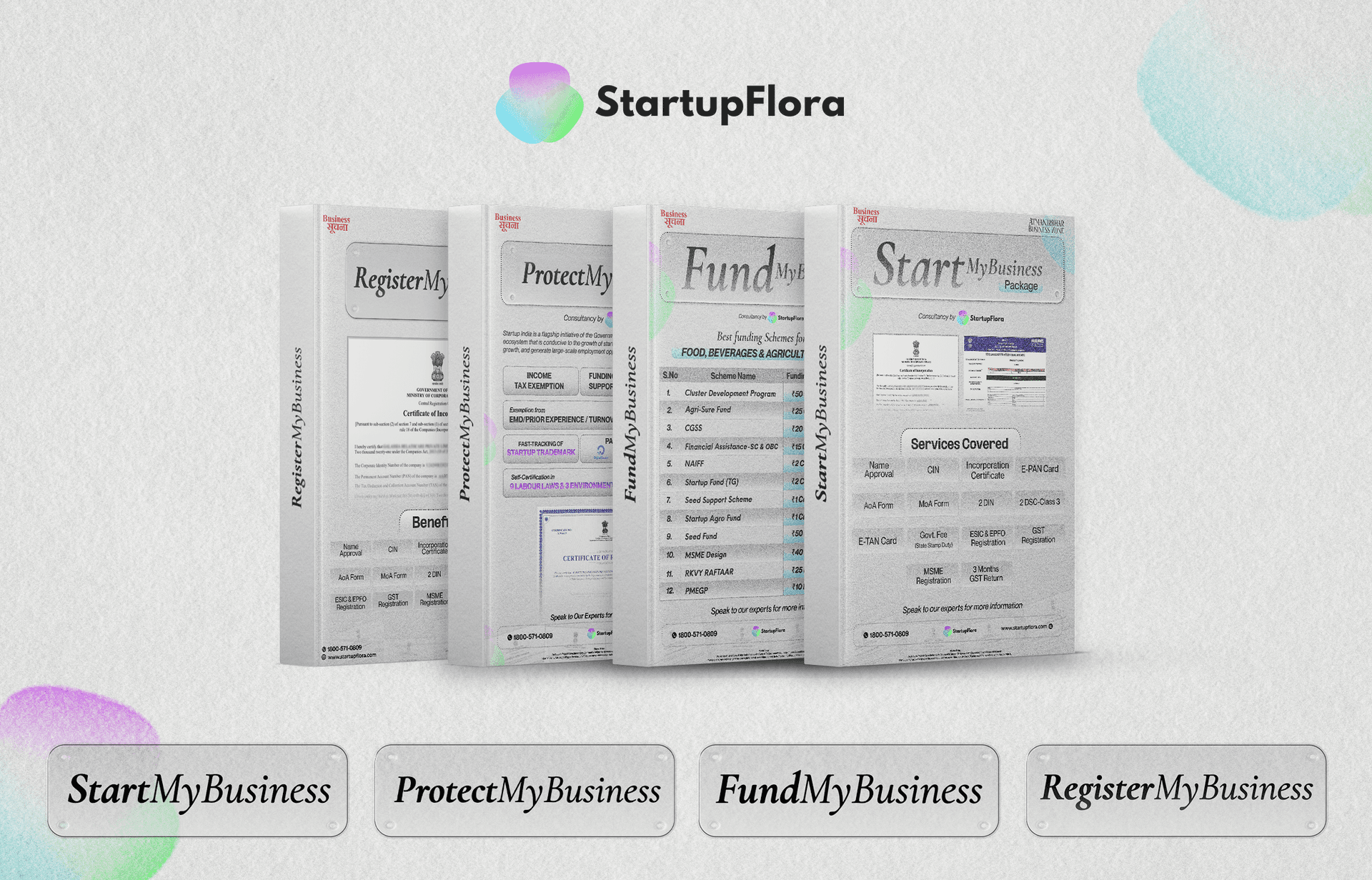

StartupFlora is your ultimate best friend, your startup superhero best friend. We will unveil their superpower, demythologize their approach, and choose the best best friend for your startup superhero quest.

Angel Investors: The Right Advisors and First Believers

Angel investors are the battle-hardened veterans of a superhero comic book series. They've battled their own wars, won their own wars, and now they're dedicated to backing the next heroes.

- Who they are: Often veteran entrepreneurs in their own right, they invest in companies they believe in with their own money. Attracted by a desire for innovation, a sense of mission to leave the world a better place, and the thrill of bringing new ideas to market, they are well-served highly experienced individuals in narrow verticals with valuable expertise and contacts.

- What they give: It is not merely money that they give; it's priceless experience, guidance, and access to their ginormous network of individuals. They have fought the wars, won the battles, and now wish to share their expertise and wisdom so you can perhaps chart your path. They can give you guidance in product development and marketing, capital raising, and getting your business started.

- What they look for: Innovative minds with fresh ideas, the enthusiasm to implement, and an attitude to be mentored. They invest in people as much as they invest in ideas, seeking entrepreneurs who are greedy, ambitious, and open to learning. They need startups with the potential to shake up markets, build value, and great returns, even if they may be in nascent phases.

Venture Capitalists: The Growth Accelerators and Powerhouse Players

Venture capitalists are as like such a wonderful superhero team with huge funds, strategic competencies, and influencer networks across industries.

- Who they are: They invest in capital of various sources varying from institutional investors to pension funds and high-net-worth individuals. They invest in high-growth startups with the potential to disrupt markets and generate astronomical returns. They are driven by passion to start innovation, create industries, and fund next-generation market leaders. They would most likely be well versed with market trends, investment models, and growth patterns.

- What they deliver: Venture capitalists deliver more than capital, although that's sufficient. They deliver a plan, a management expertise, and an enormous talent pool of lawyers, marketers, and money folks. They are your war room headquarters, providing you with the ammo and stuff you need to go warp speed and get big things done. They can assist you to rationalize your business model, streamline your operations, and avoid the pettiness of growing your business.

- What they seek: Clean record startups with scalable business model, stable management team, and healthy path to the bottom line. They seek those businesses which are most likely to be masters in their own domains, disrupt existing markets, and bring wonderfully high financial returns to their shareholders. They do wonderfully conservative due diligence and request wonderfully conservative financial projections before investing.

Picking Your Superhero: Picking the Right One for Your Startup

Your own needs, development phase, and own aspirations for tomorrow will dictate the answer.

- Seed-stage startups:Seed-stage Indian startups are perfect for angel investors. They would like to place a bet on new concepts, invest in seeds, and supply directions and feedback at the stage when it's most vital to any startup.

- High-growth start-ups: Venture capitalists are most appropriate for scaled-up start-ups with traction, who have market validation and can choose high growth at scale. They provide the fuel and mental capital to pursue high growth, build new markets, and create big ideas.

- Startup India and Funding: Let's not forget the fact that there are a myriad of different types of schemes also provided by the Indian government in order to foster early stage startups. Schemes like theStartup India seed fund scheme are an example of this government support towards small business.

StartupFlora: Your Guide to Funding Success

StartupFlora will guide you through seed fund awareness, acquiring the correct investors, best pitch decks preparation tips, and even take you through the Startup India schemes.